|

November 20, 2007 | EPI Briefing Paper #208 Building on Social Security's successby Virginia P. Reno Download print-friendly PDF version Executive SummaryThe United States needs a new conversation about how Social Security is part of the solution to the growing economic risks American workers face. The key question for policy makers is: How can we build on the strengths of Social Security—its fiscally responsible design, its universality, progressivity, efficiency, and its effectiveness–to meet the needs of working families in the 21st century? As employers shift away from traditional pensions to 401(k) plans, workers shoulder more financial risks. Social Security offers employers what they want—freedom from financial risk and fiduciary burdens—and it provides workers with what they need—economic security. Social Security has features of an ideal pension plan. It covers virtually everyone and is fully portable between jobs. Its retirement benefits last for life, keep up with the cost of living, and continue for widowed spouses in old age. Social Security provides family life insurance and disability protection. It has a permanent sponsor (the federal government) that will not go out of business or move its operations overseas. And Social Security is remarkably efficient, using less than 1% of annual income for administration. Social Security will continue to be affordable. It is not part of an “entitlement crisis.” Its cost is projected to rise to 6.2% of gross domestic product (GDP) by 2030 and to remain at about that level for 50 more years. The increase in the share of GDP going to Social Security as boomers retire is smaller than the increase in spending for public education when young boomers showed up in record numbers to enroll in kindergarten. Social Security provides bedrock security for seniors. But benefits are modest. The case for improving Social Security benefits rests on the facts that:

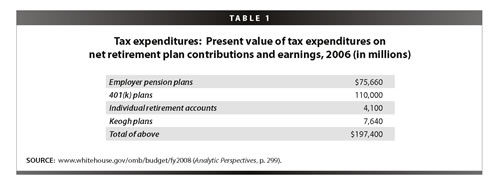

Policy makers have an excellent tool at hand to strengthen retirement security. Social Security is well designed, secure, and efficient. With its proven track record, it holds the best prospect for using new money effectively to improve retirement security. Wise policy would first balance Social Security finances without cutting benefits. It would then make benefits more adequate before subsidizing other retirement income tools. IntroductionThe Agenda for Shared Prosperity is to be commended for taking a broad look at retirement income policy. When pensions, savings, and Social Security are each considered in isolation, we risk asking the wrong questions. In the pension silo, we often ask, “How will we shore up private pensions? Can we expand the government’s role in guaranteeing pension payouts?” In the savings silo we hear, “How can we expand incentives to save? Do we need better tax deductions, refundable credits, or government matching funds?” In the Social Security silo, we ask, “How will we cut or delay benefits to reduce future costs? Can we make the cost of Social Security more predictable for the government by shifting risks to workers and families?” Something is awry with this framing of the options. A quick look at the facts reveals that Social Security is by far the most secure, effective, and efficient leg of the proverbial “three-legged stool” of retirement income. With its proven track record, it should be the top candidate for increased funding to achieve workers’ retirement security. Social Security has the unique strength of being sponsored by the federal government, the rare entity that has the power to tax and will never go out of business. In other venues (including private pensions and savings institutions), reliance on the federal government as insurer of last resort is cause for confidence. In Social Security, reliance on the federal government as insurer of first resort merits at least equal confidence. Fiscal responsibility is a core feature of Social Security (see Social Security Finances at a Glance on p. 3). Each year, the Social Security trustees report on the long-range income and payouts of the system. The purpose of the 75-year forecast is to provide early warning to policy makers if changes are needed to keep it in balance. Ironically, the long-range projections have increasingly been used to turn quite remote imbalances into the defining feature of Social Security, or to argue that the benefits are unaffordable and should be replaced with private accounts. The defining feature of private accounts, in turn, is that they do not go out of balance because they do not promise anything in particular to retirees. Instead, they shift risk from society as a whole to individual citizens. While Social Security financing is transparent, the societal costs of encouraging voluntary pensions and retirement saving is nearly hidden from view. The costs are borne through “tax expenditures,” which go overwhelmingly to upper-income households (Gist 2007). People who reap the tax benefits do not seem to recognize, or acknowledge, that society at large bears the cost. And those who do not get the tax benefits fail to see that the advantages go to others. In 2006, the present value of foregone personal income tax revenues on retirement plan contributions and earnings amounted to $197.4 billion: 401(k) plans were $110 billion, while other employer-sponsored pension plans ranked second largest at $76 billion (Table 1).

Looking across retirement income systems points us to the overarching question: “How can we provide retirement income for today’s and tomorrow’s workers and families that is secure, adequate, fair, and efficient?” Strengthening Social Security is an important part of the answer. The purpose of this briefing paper is to make the case for improving Social Security protection before putting new money into other retirement arrangements that lack the promise and successful track record of Social Security. The Case for Social InsuranceIn a National Academy of Social Insurance (NASI) brief, Why Social Insurance?, E. J. Dionne (1999) explains the concept of social insurance:

As social insurance, Social Security has many (if not all) the features of an ideal pension system. Many of these features have proven elusive in the world of employer-sponsored defined-benefit pensions or 401(k) plans. As insurance, Social Security also has features that distinguish it from personal savings accounts.

An ideal pension planAn ideal pension plan would provide security to workers and families and be convenient for employers to establish and maintain. Key features would include:

Each of these desirable features is found in the Social Security system. Furthermore, Social Security has a progressive benefit formula, which compensates for the facts that low earners need higher replacement of prior earnings in order to make ends meet and are less likely to have much in pensions or savings on top of Social Security. Finally, Social Security has a strong record of administrative efficiency. Less than 1% of funds collected each year is spent on administrative costs. Savings do not replace insurance The move from defined-benefit company pension plans to 401(k) plans improves portability but shifts risks and responsibilities from employers to workers and families. Social insurance offers employers what they seem to want—freedom from the fiduciary obligations of being a plan sponsor. With social insurance, employers are only a conduit for paying contributions and reporting wages. At the same time, social insurance gives workers what they need—security and protection from risks. The proliferation of 401(k) plans and other individual savings accounts poses many new challenges for workers about how benefits will be paid from such accounts. A blue-ribbon study panel convened by the National Academy of Social Insurance explored how benefits would be paid if individual accounts were part of Social Security. Michael J. Graetz of Yale Law School, a co-chair of that panel and a Treasury official in the administration of George H. W. Bush, summed up the problem of turning savings accounts into social insurance benefits. Personal accounts, he concluded, do not pool risk the way insurance does.

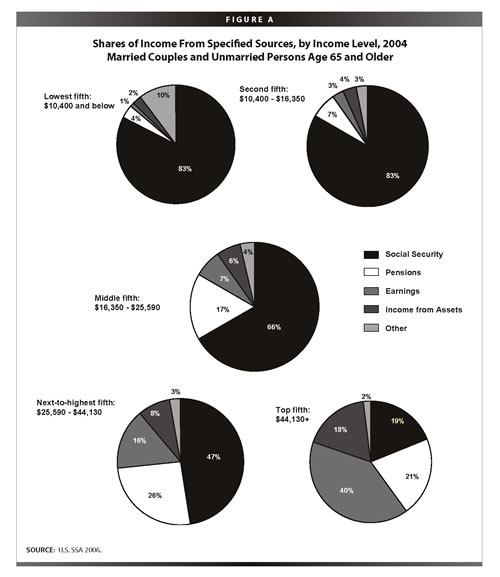

Savings do not replace insurance. For economic well-being, individuals need both. Social insurance compensates for specified losses—loss of income at retirement, disability, or death of a family worker in the case of Social Security. As insurance, Social Security protects against those risks more securely than can a savings account because it targets protection to the insured losses. Savings accounts are liquid assets that can be used for other purposes and that flexibility is part of their appeal. But savings cannot cover life’s major risks the way insurance does. When savings are depleted, they are gone, while social insurance continues for the duration of the insured losses. The distinction between social insurance and personal saving is important in debates about the form of Social Security. As Nancy Altman notes in her book, The Battle for Social Security: From FDR’s Vision to Bush’s Gamble, there has been a long-standing philosophical battle about the shape and form of Social Security. A persistent drumbeat from the libertarian right has sought to replace social insurance with private savings accounts and a residual welfare program for the very poor. That is different from the social insurance approach to retirement security. Social insurance is about community. It is about all of us sharing risk and casting our lots together. Each of us contributes while we are working and each receives benefits with dignity, as an earned right, when work ends. As Senator Bill Bradley observed, “Social Security is the best expression of community in America” (Bradley 2007). The movement to dismantle Social Security adopted new tactics after 1983 Social Security solvency legislation was enacted. Heritage Foundation scholars published a candid “Leninist” strategy to mount a long, patient campaign to divide, neutralize, and discredit the coalitions that support Social Security, including organized labor, senior citizens, young people, politicians, and policy elites (Butler and Germanis 1983). They predicted they would prevail to privatize the program in the next Social Security legislation. Key elements of the strategy were to: (a) persuade young people that they have no stake in Social Security because “it won’t be there” when they retire; (b) convince seniors that they will be protected from any benefit cuts in the transition to private accounts, so they have no reason to oppose the change; (c) convince pundits, journalists, and average Americans that Social Security is “unsustainable” and that shifting to private accounts is inevitable; and (d) persuade policymakers that fixing Social Security poses only painful choices that are best avoided. Claims that Social Security is unsustainable or will not be there for future generations are not consistent with experience over the last 70 years and are not borne out by official projections of the Social Security program over the next 75 years. The next section of this paper briefly makes the case that Social Security is affordable. The following sections present the case for more adequate benefits and describe illustrative ways to improve Social Security. Social Security Is AffordableA quick look at the facts shows that the Social Security is affordable. Contrary to much public discussion, it is not an “entitlement crisis.” Future benefits are a predictable share of the economy As a share of the total economy, Social Security is forecast by the trustees to rise from 4.3% in 2007 to 6.2% by 2030, an increase of 1.9 percentage points. This is a sizeable increase, to be sure. But we can put it in context by answering two questions: Why does the share grow, and is this a big change compared to past experience? Social Security will grow as a share of the economy because the share of population that is over age 65 will grow rapidly between now and 2030. Seniors are 13% of the population today and will be about 20% of the population in 2030. After 2030, the share of the economy represented by Social Security will remain fairly stable at 6.2% to 6.3% for the rest of the 75-year projection period (Trustees 2007). As elders comprise a larger share of the population, it is reasonable to expect that they will consume a commensurately larger share of the economy’s goods and services. To require otherwise is to require that future elders be less well off relative to everyone else than is the case today. Is a 1.9 percentage point increase in Social Security’s share of gross domestic product (GDP) a dramatic change by historical standards? No. It is smaller than the growth in spending for public education when boomers were children. Spending on public education rose by 2.8 percentage points between 1950 and 1975, from 2.5% to 5.3% of GDP (SSA 1991; Reno and Lavery 2006). At the time, the need for education spending came with little warning. Local governments had to respond quickly to add classrooms and teachers as boomers showed up in record numbers to enroll in kindergarten. The fact that boomers will become eligible for Social Security benefits when they reach age 62 is not a surprise. It has been part of the official Social Security projections since boomers were born. It is not an “entitlement crisis” Social Security is sometimes billed as the centerpiece of an “entitlement crisis” in the federal budget that will consume us all, including our children and grandchildren. That billing lumps together projections for Social Security, Medicare, and Medicaid. As Henry Aaron (2007) and other leading health policy scholars have noted, the main reason for growth in those programs is the rising per capita cost of health care. Moreover, only part of the nation’s rising health care bill appears in the federal budget, where it shows up in Medicare and Medicaid for the elderly, disabled, and poor and veterans’ and military health care for injured service members. The larger part of health spending is in the private sector. There are no 75-year projections of private spending, but the burdens are no less real. They are felt by: employers who pay health insurance premiums for their workers; families who pay growing out-of-pocket bills; and facilities that provide uncompensated care for uninsured patients. All payers face rapidly rising bills. Per capita spending has grown no faster in public programs (such as Medicare) than in private insurance (Van de Water 2007). Organizing and paying for health care is a top national priority. A sensible approach will consider public and private spending together. If the health care financing problem is solved, there is no remaining projected long-term fiscal shortfall (Aaron 2007). Unlike health care, Social Security will remain a predictable and stable share of the total economy at about 6.3% of GDP over the long term, which is affordable. The Case for Improving BenefitsSocial Security provides bedrock security for seniors, but benefits are modest. The case for improving Social Security benefits rests, in part, on the fact that U.S. replacement rates from Social Security are low, and U.S. elders are at greater risk of being poor than are elders in other advanced economies. At the same time, Social Security is critically important to beneficiaries today. Social Security replacement rates, however, will decline from an already modest base for future retirees, and seniors in the future will lag behind workers in sharing the gains of economic growth. At the same time, employers are moving away from traditional pension commitments, leaving Social Security as the only source of guaranteed benefits for the vast majority of retirees in the future. Social Security is essential for retirees Social Security has long been a source of bedrock security for retirees. Almost all elders receive it. It lifts 13 million elders out of poverty. Without counting Social Security income, nearly one in two seniors would be poor; with Social Security benefits, fewer than one senior in 10 is poor (Sherman and Shapiro 2005). While it is an important anti-poverty program, Social Security is a critical source of income for middle-income and upper-middle-income seniors as well as for low-income retirees. Figure A shows elders divided into five equal groups based on their total incomes. Each pie chart shows the share of the group’s total income from Social Security, pensions, earnings from work, asset income, and all other sources. Elders in the bottom two-fifths of the income distribution in 2004 (with incomes below $16,350) drew 83% of their income from Social Security. Elders in the middle group (with incomes between $16,350 and $25,590) received two-thirds of their income from Social Security, while those in the upper-middle group (with between $25,590 and $44,130 in income) received nearly half of their total income from Social Security. Only in the highest income group (over $44,130) is Social Security not the largest source. Income from work was the largest source of income because most elders in this top income group were not fully retired. In the lower four income groups (where most elders are fully retired), Social Security is by far the largest single source of income, while pensions ranked second, and asset income ranked third (Social Security Administration 2006; Reno and Lavery 2007).

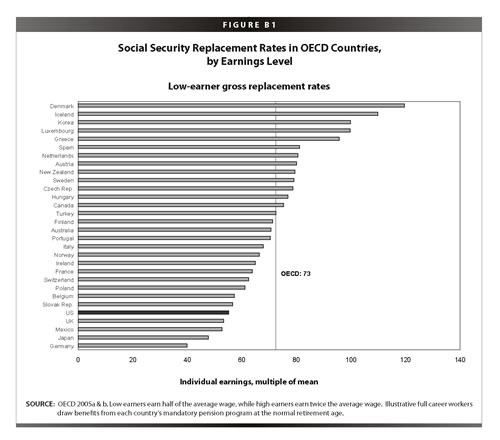

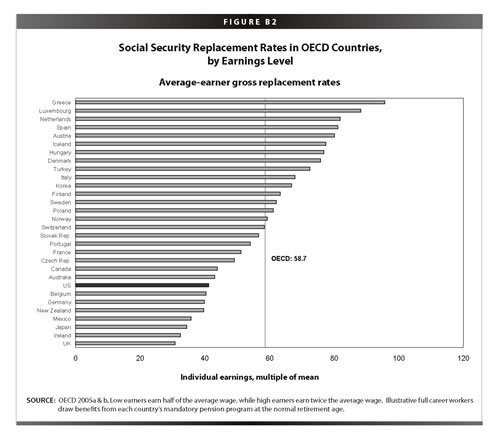

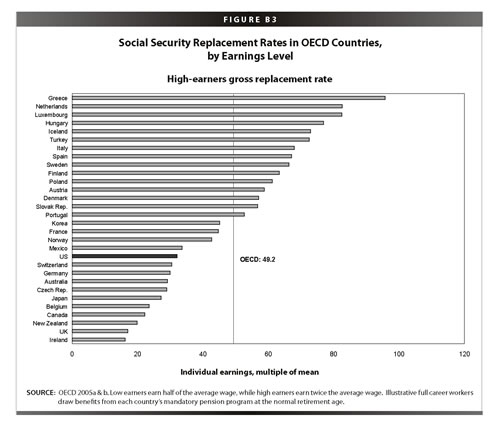

Social Security is particularly important to vulnerable groups. Almost 80% of African American beneficiaries age 65 and older depend on their Social Security benefits for 50% or more of their income; fully 44% of African American elder beneficiaries receive all of their income from Social Security (Wu 2007). Replacement rates are low by international standards Compared with other advanced economies, U.S. Social Security replacement rates are low. Of 30 nations studied by the Organisation for Economic Cooperation and Development (OECD), U.S. replacement rates from Social Security rank fifth from the bottom for low earners, eighth from the bottom for average earners, and 11th lowest for high earnings (Figures B1, B2, B3). Countries that have higher replacement rates generally devote more of their national resources to Social Security pensions for retirees.

The United States has traditionally had a larger stock of private retirement funds than exists in other countries, but that private retirement wealth is held overwhelmingly by the upper-income segment in the United States and will not provide retirement support for most Americans (Bailey and Kirkegaard 2007). U.S. seniors are at high risk of inadequate incomes Replacement rates define income adequacy relative to prior earnings. Dollar thresholds define adequacy in terms of meeting the costs of basic necessities. Both are useful. Low-wage workers, for example, may find that replacing even a high portion of prior earnings leaves them unable to meet basic needs. How much do elders need to pay for essentials? The official U.S. poverty guidelines ($10,210 a year for an individual and $13,690 for a couple in 2007) are often used as a proxy for minimum adequate income. But they are increasingly outdated because they do not reflect changes in living standards or spending patterns since the poverty thresholds were first developed about 45 years ago. A new Elder Economic Security Standard finds that income at the official poverty levels falls short of meeting basic needs today. The new standard is being developed for each of the 50 states and for local areas within states to assess how much retired couples and single individuals will need to make ends meet (Wider Opportunities for Women 2006). The first study was done in Massachusetts and found that retired couples and elders living alone could not make ends meet at the poverty level. In fact, depending on their housing, health, and geographic locations, elders would need between 150% and 300% of the official poverty level to meet basic living expenses without turning to means-tested assistance (Russell, Bruce, and Conahan 2006). Average Social Security benefits fall short of meeting the new Elder Economic Security Standard but are somewhat higher than the official U.S. poverty thresholds. The average Social Security benefit was about $12,600 a year for retired workers and about $20,560 for retired couples with both spouses receiving benefits in 2007 (SSA 2007). U.S. seniors are at greater risk of being poor than are elders in other advanced economies. Internationally, poverty is defined as having income less than 50% (or 40% or 60%) of median income for households of similar size. Most cross-national studies use the 50% standard, which shows that roughly one in four older Americans is poor (Smeeding and Sandstrom 2005). Moreover, nearly half (46%) of women who live alone beyond age 65 are poor. Using the lower threshold of 40% of median income, about 15% of American elders are poor, including 30% of women living alone. By either standard, elders are at greater risk of having inadequate income in the United States than in the other six countries studied—and significantly more likely to be poor than in Canada, Germany, Italy, Sweden, and Finland (Table 2).

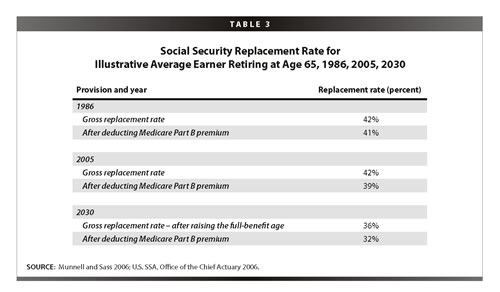

Replacement rates will decline for future retirees Retirees will get less adequate wage replacement from Social Security in the next 25 years than has been the case for retirees over the past 25 years (Table 3). The replacement rate for a medium earner retiring at age 65 is now about 39% after deducting the premiums for Medicare Part B, which pay for doctors’ bills and are deducted directly from Social Security checks. By 2030, the net replacement rate for a similar 65-year-old retiree will drop to about 32% (Munnell and Sass 2006).

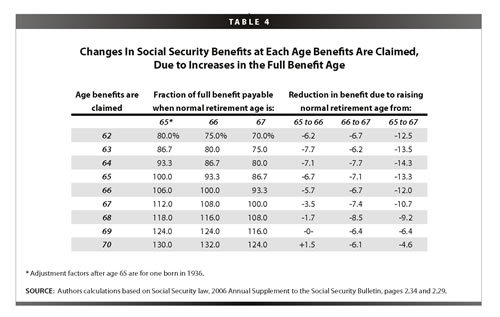

Reasons for this decline include the legislated increase in the “full-benefit age” for receiving Social Security benefits and rising Medicare premiums that are deducted directly from Social Security benefits. Increase in the full-benefit age. In 1983 Congress enacted an increase in the Social Security “full-benefit age” from 65 to 67. This change is taking place gradually for new retirees between 2000 and 2025. The age at which full (100%) benefits are available rises from 65 (for persons born before 1938) to 66 (for persons born in 1943 through 1954). The full-benefit age then rises again to 67 (for persons born in 1960 and later). Table 4 illustrates the change in benefit at each age, due to this 1983 revision in policy. Each time the eligibility age goes up by one year, benefits claimed at each age are reduced by 6-7%. When the full-benefit age is 67, benefits claimed at ages 62-66 will be about 12-14% lower than they would have been without this change in law.

Rising Medicare premiums. Medicare premiums will take a bigger bite out of Social Security checks in the future. Premiums go up with the cost of health care, while Social Security benefits rise with the rate of general inflation. The standard Medicare Part B premium is $93.50 a month in 2007, and the national average Part D monthly premium for prescription drug program is $27.35. Beneficiaries are also responsible for other out-of-pocket costs for Parts B and D of Medicare. Total out-of-pocket spending for Supplementary Medical Insurance—premiums, deductibles, and coinsurance for parts B and D of Medicare—amount to 29% of the average Social Security benefit in 2007. By 2040, such out-of-pocket expenses are projected to equal about half of the average Social Security benefit (Munnell 2007; Centers for Medicare and Medicaid Services 2007). The Social Security benefit reductions already in law and retirees’ growing obligations for cost-sharing under Medicare suggest that benefit increases will be needed in the next 25 years just to maintain the replacement rates retirees have known for the past 25 years. Retirees’ benefits will lag behind workers’ earnings A similar conclusion is reached when comparing the projected well-being of workers and retirees in 2030. Thompson (2005) compares the economic gains of future workers and retirees in light of projected real wage growth and the costs of paying for Social Security, Medicare, and out-of-pocket health costs and found that workers will fare better than retirees. The average worker’s wages are projected to rise by 31% in real terms between 2003 and 2030 (Table 5). This is the net increase after deducting out-of-pocket health spending for the worker and the higher income taxes that would be needed to keep Medicare Parts B and D solvent. General revenues (largely income taxes) pay for the portion of Part B (for doctor bills) and Part D (for drug benefits) that is not financed by enrollee premiums. While the worker’s net earnings go up by 31%, Social Security income for a retiree with an average earnings history will rise by just 10%. The net increase for the retiree takes account of benefit cuts due to a higher full-benefit age, income taxes on Social Security benefits, rising premiums for parts B and D of Medicare, and rising out-of-pocket health costs.

Thompson concludes that if the pay-as-you-go cost of Social Security and Hospital Insurance under Medicare were met solely by raising taxes on wages, the gap between workers and retirees would narrow.1 But retirees would still lag behind workers: workers’ net wages would rise by 21% by 2030 (see final row of Table 5) instead of 31% in the baseline, while retirees’ net monthly income would rise by just 10% (unchanged from the baseline). The findings support the case for raising revenues (rather than cutting benefits) to balance Social Security finances. They also support the case for making benefits more adequate. Employers are freezing defined-benefit pensions The case for increasing Social Security benefits becomes more compelling as more and more employers are ending their commitments to defined-benefit pensions. Until recently, relatively few companies closed their defined-benefit plans, and those that did were typically facing bankruptcy or struggling to stay alive. Today, growing numbers of healthy companies are freezing defined-benefit plans and shifting to 401(k)s (Munnell et al. 2006). McKinsey & Company (2007), a global management consulting firm, predicts that the trend will accelerate; by 2012 between 50% and 75% of private defined-benefit plan assets will be frozen or terminated, up from 25% in 2007. A survey by the Employee Benefit Research Institute and Mercer Human Resource Consulting also finds the trend will continue: About a third of plan sponsors reported they had changed their plans in the past two years, and another third said they plan to change in the next two years (EBRI 2007). Typical changes were to freeze defined-benefit plans for new hires or for all participants and to increase employer contributions to 401(k) plans. Companies say they are freezing defined-benefit plans in order to control current and future costs and reduce their volatility (Vanguard 2007). Others blame new funding requirements of the Pension Preservation Act of 2006 (which start to take effect in 2008) and new requirements of the Financial Accounting Standards Board that companies show pension fund surpluses or deficits on their corporate balance sheets (EBRI 2007; McKinsey 2007). Others report that global competition leaves employers less willing or able to bear investment and longevity risks that are inherent in guaranteeing defined-benefit pensions. Finally, some point to a split between retirement packages for corporate leaders vis a vis rank and file workers such that executives no longer have a personal stake in the plans for their employees (Munnell et al. 2007). If Social Security is becoming the sole defined-benefit plan for more and more retirees, the case for making it adequate is even more compelling. 21st Century Retirement: Social Insurance and Voluntary SupplementsThese developments lead to a vision of two tiers of retirement income: A foundation of more adequate Social Security benefits topped off by voluntary arrangements. The voluntary tier would include remaining defined-benefit pension plans (that today cover about 20% of private sector workers) and individual retirement accounts (IRAs), 401(k) plans, and other voluntary savings. Proposals to shift tax subsidies for retirement savings from tax deductions to refundable tax credits (Gale et al. 2006; Batchelder et al. 2006) offer revenue-neutral ways to improve the fairness of elements of this tier of retirement income. There is merit in having a solid layer of voluntary savings on top of Social Security. Savings embody many features that workers like—choice, ownership, discretion about how the money is used, and the chance to leave bequests. These features underlie the popularity of personal savings and are not found in Social Security. At the same time, Social Security has the advantage of targeting more adequate protection to individuals who experience insured losses, and that support is guaranteed. While voluntary savings on top of Social Security are desirable, it would not be sound policy to devote new public funds to savings accounts until Social Security benefits are adequate. The top priority for new spending should ensure an adequate shared foundation. Individuals can save for retirement on their own. But individuals, acting alone, cannot strengthen the social insurance foundation. That requires action by elected policy makers.

Paying for Social Security Financing Social Security in the future involves both paying for benefits in current law and paying for any improvements. Paying for current law. This paper assumes that proposals made by Nancy Altman and Robert M. Ball to balance Social Security finances without benefit cuts are adopted (Altman 2005). As Ball (2007) explains, those changes would:

Taken together, these changes broaden the revenue base, improve the progressivity of Social Security finances, and adequately finance current-law benefits, which are projected to remain between 6.2% and 6.3% of gross domestic product after 2030. Because almost everyone is covered by Social Security, broadening the tax base would help share the future cost more equitably among all Americans. Paying for improvements. New revenues will be needed to pay for more adequate benefits. For simplicity, we discuss revenue increases in terms of percentages of Social Security covered wages, although other sources of revenue could be justified. If we increased contributions on wages to pay for better Social Security protection, any increase in the burden on low-paid workers could be offset by adjustments to the earned income tax credit (EITC). That was the purpose of the EITC when it was enacted in 1975—to increase the return from work for low-paid workers by offsetting the burden of Social Security and Medicare taxes, while at the same time maintaining the workers’ participation in and entitlement to benefits of the social insurance programs. The EITC today is effective for families with children, but provides very modest relief for childless workers (Aron-Dine and Sherman 2007). Workers with and without children should get relief through EITC adjustments in tandem with any increases in Social Security contributions. Can America afford to pay more? What America can afford is largely a question of values. The United States is one of the least taxed industrialized countries. Twenty-eight out of 30 countries in the Organisation of Economic Cooperation and Development (OECD) pay a larger share of GDP in taxes than does the United States. Only Korea and Mexico pay less. In 2005, total federal, state, and local taxes in the United States were 25.8% of GDP; the other 29 OECD countries paid 35.5% (Citizens for Tax Justice 2007). The form and purpose of taxes also matter. New research finds that high social spending in European democracies has not slowed economic growth as long as benefits and taxes are well designed. In his two-volume work, Growing Public: Social Spending and Economic Growth Since the Eighteenth Century, distinguished economist Peter H. Lindert (2004) concludes that social insurance programs that cover nearly the entire population and are financed by broad-based, low-rate taxes—such as payroll or value-added taxes—have almost no negative impact on a country’s ability to grow and prosper (Lavery 2007).

Illustrating ways to improve benefit adequacy The goal of this paper is to begin a new conversation about how Social Security is part of the solution to the growing risks facing American workers. New thinking and fresh analysis are needed to define the optimal role of Social Security in a two-tier retirement income system for the 21st century. Detailed recommendations are beyond the scope, (and time and data available) for this paper. Policy options here are meant to stimulate discussion and promote fresh ideas about ways to improve Social Security once the right questions are being addressed. For too long, public discourse on Social Security has defined the program as a problem for policy makers, rather than a solution for workers. The right questions are not: “How can we privatize Social Security to shift risks from government to workers?” or “How should we cut benefits to make it cost less?” Rather the right questions are:

Each of the options listed in Table 6 is described briefly. Adopt across-the-board increases. If increased contributions were devoted to Social Security, how much could policy makers increase benefits across the board? As a rough rule of thumb:3

These increases would represent important income gains to retirees because Social Security is such as large part of their total incomes. For example, Social Security is about two-thirds of the total income of middle-income retirees (Figure A), so a 30% increase in benefits would raise total income by nearly 20%. For low-income elders (who receive 83% of their income from Social Security), a 30% benefit increase would raise total incomes by about 25%, on average. Restore part of the benefit cuts due to a higher full benefit age. The increase in the Social Security full-benefit age that was enacted in 1983 brings an across-the-board cut in retirement benefits at each age benefits are claimed. It is implemented in two phases. The first phase changed the full-benefit age from 65 (for people born before 1938) to 66 (for people in 1943 through 1954) and cut retirement benefits by 6-7%. The second phase will change the full-benefit age to 67 (for those born after 1960) and will cut retirement benefits by another 6-7%. The second phase of the increase has not yet affected any retirees. Policy makers could improve the adequacy of retirement benefits by rescinding the second increase in the full benefit age. That would increase Social Security old-age benefits by about 7% over 75 years. It would increase total program costs a little less than 6% because disability and young survivor benefits are not affected by retirement age adjustments. Improve benefits for widowed spouses in old age. Women living alone after age 65 are at high risk of being poor. Fully 45% of U.S. women living alone after age 65 are poor, using the international poverty measure (Table 2). Because women live longer than men and wives are typically younger than their husbands, they are very likely to end up widowed and live alone in old age. Widowed spouses are also at risk of depleting other financial resources during partners’ final illnesses. Social Security benefits should help bridge the transition from couple to survivor. For a one-earner couple, the survivor receives two-thirds of the amount the couple received while both were alive. But survivor protection is less adequate when both husbands and wives worked at low pay. The surviving spouse receives the higher of her (or his) own benefit, or the deceased spouse’s benefit, whichever is larger. If the husband and wife had roughly equal benefits from their own work, the survivor would get about half (instead of two-thirds) of the couple’s prior benefit income. Raising the benefit for widowed spouses to three-fourths of whatever the couple would be receiving if both were still alive would improve protection for widowed spouses. This change has been estimated to increase the cost of benefits under current law by about 0.32% of taxable payroll (Advisory Council on Social Security 1996). A raise for octogenarians: 10% increase at age 85. Individuals who live into their late 80s and 90s are at growing risk of becoming poor. They rely more and more on Social Security as other sources of income dwindle: private pensions, if received, are eroded by inflation; income from work is no longer an option; and financial assets may have been spent. Some have proposed a Social Security benefit increase at a specified age to address the increasing financial vulnerability of the oldest old. Currently about 10% of all Social Security benefits are paid to individuals age 85 and older (Social Security Administration 2005). To raise benefits by 10% for beneficiaries who have passed their 85th birthdays would increase Social Security costs by about 1% today, but more in the future as longevity increases. It is estimated (roughly) in Table 6 that this change would increase costs by 0.32% of covered wages. Restore student benefits. During a 15-year window, from 1965 through 1981, Social Security benefits for children of deceased, disabled, or retired workers continued up to age 22 for children who were full-time students in high school, college, or vocational school. Legislation enacted in 1981 eliminated those benefits. Now children’s benefits end at age 18, or 19 if the child is still in high school. As today’s families struggle to meet the rising cost of higher education, there is renewed interest in reviving student benefits through the Social Security program. At their peak, Social Security paid benefits to one out of 10 college students (Dynarski 1999). The benefits were particularly important to African American children because their mothers and fathers have higher risk of dying or becoming disabled (Global Justice Now 2006). A profile of student beneficiaries found that they resembled other college students in their own educational characteristics; but they came from less well-off families (Springer 1987): Beneficiary students are more likely to be black and to have parents who had worked at blue-collar occupations. Family income, with one parent—usually the father—no longer working because of death, disability, or retirement, was lower than the incomes of families nationally and much lower than the incomes of other families with children in college. College student beneficiaries are more likely than college students generally to have fathers with lower educational attainment….[Student beneficiaries] were more likely to work than college students in general while they maintained similar grades. In brief, the availability of Social Security benefits appears to have aided upward mobility for children whose families had suffered the loss of a parent’s income through death, disability, or retirement. Restoring student benefits beginning in 2001 was estimated to cost $50 billion over 10 years and to increase Social Security cost over 75 years by 0.1% of Social Security covered payroll (Social Security Administration 2000). Create a benefit guarantee for long-service, low-paid workers. Various groups have proposed increasing benefits for long-service, low-paid workers to ensure that such individuals receive benefit incomes above the poverty threshold. Some such proposals are designed to mitigate the adverse effects on vulnerable populations of plans to reduce Social Security costs by further increasing the retirement age, cutting benefits across-the-board, or shifting part of Social Security funds to personal accounts. A special minimum benefit could be designed to achieve specific adequacy goals, such as assuring that anyone who had 40 years of work under Social Security would have a benefit that achieved, say, 120% of the poverty threshold. A proposal offered in 1981 by a National Commission on Social Security (appointed during the Carter administration) called for a new special minimum benefit that would raise benefits to what was then the poverty threshold for individuals who had at least 35 years of Social Security credits. It would also grant credit toward that benefit for up to 10 years of child care (National Commission on Social Security 1981). Special minimum benefits involve many design issues that need to be analyzed and tested to ensure that they produce the intended results (Favreault et al. 2007a; Favreault et al. 2007b). Design issues need to address such questions as: What level of earnings is needed to count as a year of coverage? Can workers get a partial year of coverage if they earn less than the amount needed for a full year of coverage? Will the special minimum benefit for each new cohort of retirees rise by wage growth (as other retirement benefits do)? Will the special minimum benefit keep up with the cost of living after retirement (like other retirement benefits do)? Can other valued work—such as unpaid care for children or other dependent individuals in need of care—count toward the special minimum benefit? If so, can past years of care-giving service count toward the benefit for future retirees? This is an important area for advocates and analysts to engage in policy development to produce workable plans. —Virginia Reno is the vice president for income security at the National Academy of Social Insurance. This paper does not reflect an official position of the National Academy of Social Insurance. The author is grateful for helpful comments from Henry Aaron, Nancy Altman, Robert Ball, John Irons, Robert Kuttner, Joni Lavery, Monique Morrissey, Ross Eisenbrey, Joe Quinn, Bob Rosenblatt, Gerry Shea, Margaret Simms, and Paul Van de Water. Any errors are the sole responsibility of the author. Endnotes1. It is assumed that workers would bear the burden of increasing both the employee and the employer share of the Social Security and Medicare taxes on wages. 2. Employee contributions to 401(k) plans are included in the Social Security tax base. 3. These estimates assume that the Ball/Altman proposal are adopted, including the increase in the contribution base to cover 90% of wages (instead of 83%) under current law. ReferencesAaron, Henry. 2007. “Budget Crisis, Entitlement Crisis, Health Care Financing Problem –Which Is It?,” Health Affairs, Nov/Dec, vol. 26, no. 6. Advisory Council on Social Security. 1997. Report of the 1994-1996 Advisory Council on Social Security, Volume I: Findings and Recommendations. Washington, DC: Social Security Administration. January. Altman, Nancy J. 2005. The Battle for Social Security: From FDR’s Vision to Bush’s Gamble, Hoboken, NJ: John Wiley & Sons, Inc. Aron-Dine, Aviva and Arloc Sherman. 2007. Ways and Means Committee Chairman Charles Rangel’s Proposed Expansion of the EITC for Childless Workers: An Important Step to Make Work Pay. Washington, DC: Center on Budget and Policy Priorities. October 25. Ball, Robert M. 2007. “A Social Security Fix for 2008.” Washington, DC: The Washington Post, p. A15. October 29. Baily, Martin Neil and Jacob Funk Kirkegaard. 2007. Social Security Reform: Lessons from the World Experience with Individual Accounts. PowerPoint Presentation at Ford Foundation Forum. July 11, New York City. Washington, DC: Peterson Institute for International Economics. Batchelder, Lily L., Fred T. Goldberg, Jr., and Peter R. Orszag. 2006. Reforming Tax Incentives into Refundable Tax Credits, Policy Brief #156. Washington, DC: The Brookings Institution. August. Board of Trustees. 2007. The 2007 Annual Report of the Board of Trustees of the Federal Old-Age and Survivors Insurance and Federal Disability Insurance Trust Funds. April 23. Bradley, Bill. 2007. E-mail correspondence with Virginia P. Reno, Washington, DC: National Academy of Social Insurance. October 15. Butler, Stuart and Peter Germanis. 1983. “Achieving a ‘Leninist’ Strategy.” Cato Journal, Fall 1983, vol. E no. 2. Washington, DC: Heritage Foundation, Washington, DC. Centers for Medicare and Medicaid Services, 2007. Annual Report of the Boards of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds. Washington, DC: U.S. Department of Health and Human Services. Citizens for Tax Justice. 2007. “United States Remains One of the Least Taxed Industrialized Countries.” Washington, DC: Citizens for Tax Justice. April. Dynarski, Susan. 1999. “Does Aid Matter? Measuring the Effect of Student Aid on College Attendance and Completion.” NBER Working Paper No. 7422. November. Favreault, Melissa M., Gordon B.T. Mermin, and C. Eugene Steuerle. 2007. “Minimum Benefits in Social Security: Design Details Matter.” Older Americans’ Economic Security Brief Number 10. Washington, DC: The Urban Institute. January. Favreault, Melissa M., Gordon B.T. Mermin, C. Eugene Steuerle, and Dan Murphy. 2007. “Minimum Benefits in Social Security Could Reduce Aged Poverty.” Older Americans’ Economic Security Brief Number 11. Washington, DC: The Urban Institute. January. Gale, William G., Jonathan Gruber, and Peter R. Orszag. 2006. Improving Opportunities and Incentives for Saving by Middle- and Low-Income Households. The Hamilton Project. Discussion Paper 2006-02. Washington, DC: The Brookings Institution. April. Gist, John R. 2007. Spending Entitlements and Tax Entitlements. Report #2007-10. Washington, DC: AARP Public Policy Institute. May. Global Justice Now. 2006. “Check Out the Facts about African Americans and Social Security.” Washington, DC: Black Student Justice Network. Government Accountability Office (GAO). 2007. Retirement Security: Women Face Challenges in Ensuring Financial Security in Retirement. Report to the Ranking Member, Special Committee on Aging, U.S. Senate. GAO-08-105. October. Lavery, Joni. 2007. Social Insurance Benefits Need Not Limit Economic Growth: New Evidence. Health and Income Security Brief No. 10. Washington DC: National Academy of Social Insurance. September. Lindert, Peter H. 2004. Growing Public: Social Spending and Economic Growth Since the Eighteenth Century. New York City: Cambridge University Press. McKinsey & Company. 2007. The Coming Shakeout in the Defined Benefit Market. New York City: McKinsey & Company. Munnell, Alicia H. 2007. Medicare Costs and Retirement Security. Boston College: Center for Retirement Research. Issue Brief Number 7-14. October. Munnell, Alicia H. and Steven A. Sass. 2006. Social Security and the Stock Market: How Pursuit of Market Magic Shapes the System. Kalamazoo, MI: W. E. Upjohn Institute for Employment Research. Munnell, Alicia H., Francesca Golub-Sass, Mauricio Soto, and Francis Vitagliano. 2006. Why Are Healthy Employers Freezing their Pensions? Issue Brief Number 44. Boston College: Center for Retirement Research. March. National Commission on Social Security 1981. Final Report of the National Commission on Social Security. Milton Gwirtzman (chair). March. Organisation for Economic Co-operation and Development (OECD). 2005a. Pensions at a Glance: Public Policies Across OECD Countries. Paris: OECD Publishing. Organisation for Economic Co-operation and Development (OECD). 2005b. Solving the Pension Puzzle. OECD Policy Brief. Paris: March. National Commission on Retirement Policy (NCRP). 1999. The 21st Century Retirement Security Plan: Final Report of the National Commission on Retirement Policy. Washington, DC: Center for Strategic and International Studies. Reno, Virginia P. and Johanna Gray. 2007. Social Security Finances: Findings of the 2007 Trustees Report. NASI Social Security Brief No. 24. Washington, DC: National Academy of Social Insurance. April. Reno, Virginia P. and Joni Lavery. 2007. Social Security and Retirement Income Adequacy. NASI Social Security Brief No. 25. Washington, DC: National Academy of Social Insurance. May. Reno, Virginia P. and Joni Lavery. 2006. Can We Afford Social Security When Baby Boomers Retire? NASI Social Security Brief No. 22. Washington, DC: National Academy of Social Insurance. May. Reno, Virginia P,. Michael J. Graetz, Kenneth S. Apfel, Joni Lavery, and Catherine Hill (eds.). 2005. Uncharted Waters: Paying Benefits from Individual Accounts in Federal Retirement Policy: Study Panel Final Report. Co-chairs Kenneth S. Apfel and Michael J. Graetz. Washington, DC: National Academy of Social Insurance. Russell, Laura Henze, Ellen A. Bruce and Judith Conahan. 2006. The Elder Economic Security Standard for Massachusetts. Gerontology Institute. Boston: University of Massachusetts; and Wider Opportunities for Women. December. Russell, Laura Henze, Ellen A. Bruce and Judith Conahan. 2006. The WOW-GI National Elder Economic Security Standard: A Methodology for Determine Economic Security for Elders. Washington, DC: Wider Opportunities for Women. Sherman, Arloc and Isaac Shapiro. 2005. Social Security Lifts 13 Million Seniors Above the Poverty Line: A State by State Analysis. Washington, DC: Center on Budget and Policy Priorities. February 24. Social Security Administration. 2007. Cost of Living Adjustments, 2006 Social Security Changes. Office of the Chief Actuary. http://www.ssa.gov/cola/colafacts2007.htm Social Security Administration. 2006. Income of the Population 55 and Older, 2004. www.socialsecurity.gov.policy. Social Security Administration. 2003. Statistical supplement to the social security bulletin. Table 5A1. Social Security Administration. 2000. Letter from Daniel T. Durham, Deputy Associate Commissioner for Retirement Policy to Hans Riemer, Director of the 2030 Center, Questions and Answers on Restoring the Student Benefit to the Pre-1981 level. June 2 Social Security Administration. 1991. Annual Statistical Supplement to the Social Security Bulletin, 1991. Washington, DC: Office of Policy, Office of Research, Evaluation and Statistics. Smeeding, Timothy and Susanna Sandstrom. 2005. Poverty and Income Maintenance in Old Age: A Cross-National View of Low Income Older Women. Luxembourg Income Study Working Paper Series. Paper No. 398. January. Thompson, Lawrence H. 2005. “Paying for Retirement: Sharing the Gain.” In Search of Retirement Security: The Changing Mix of Social Insurance, Employee Benefits, and Individual Responsibility. Ghilarducci, Teresa, Van Doorn Ooms, John L. Palmer and Catherine Hill (eds.). Papers delivered at the 16th Annual Conference of the National Academy of Social Insurance.) New York. NY: The Century Foundation. Utkus, Stephen P. 2007. Recent Changes to Defined Benefit Plan Design. The Vanguard Group: Vanguard Center for Retirement Research. October. VanDerhei, Jack. 2007. Retirement Income Adequacy After PPA and FAS 158: Part One – Plan Sponsors’ Reactions. Issue Brief No. 307. Washington, DC: Employee Benefit Research Institute. July. Wu, Ke Bin. 2007. African Americans Age 65 and Older: Their Sources of Retirement Income in 2005, Fact Sheet Number 137. Washington, DC: AARP Public Policy Institute. September. |

|

|||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||